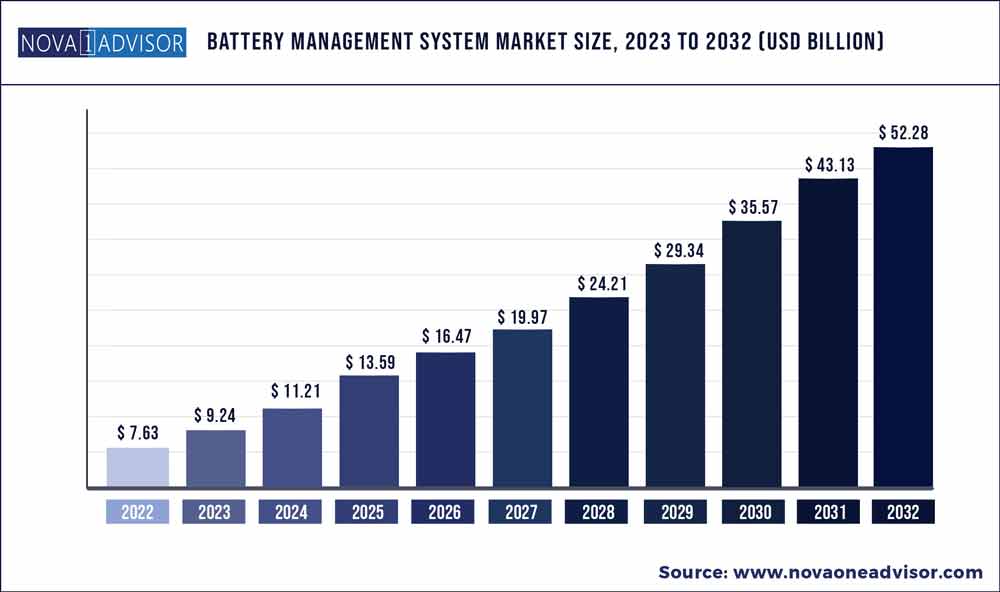

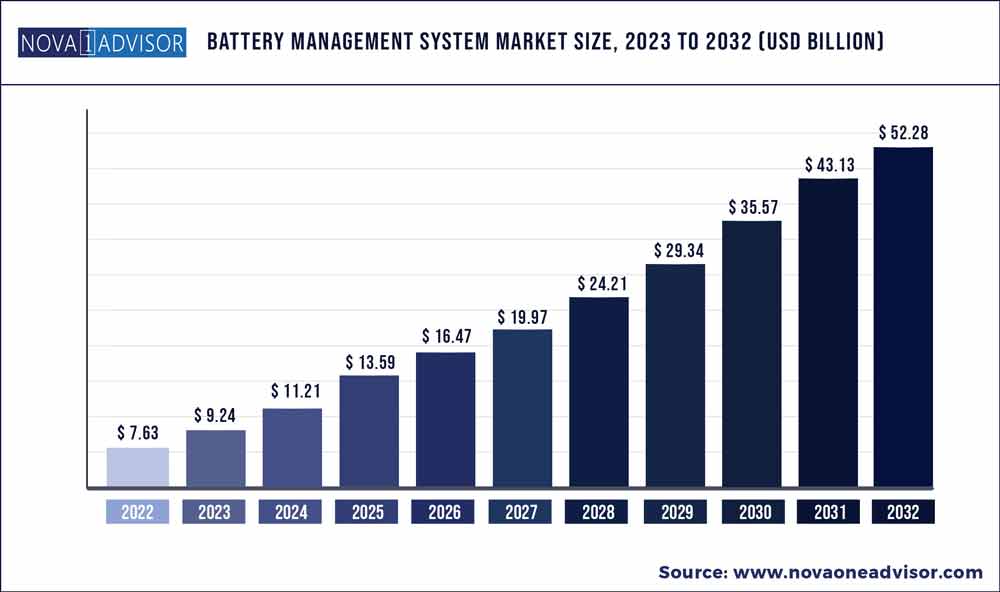

The global battery management system market size was exhibited at USD 7.63 billion in 2022 and is projected to hit around USD 52.28 billion by 2032, growing at a CAGR of 21.23% during the forecast period 2023 to 2032.

Key Pointers:

- By application, the automotive segment has held market share of over 55.19% in 2022.

- By battery, the flow battery segment has captured market share of over 32.9% in 2022

- The North America market has generated market share of 31.11% in 2022.

- Europe region has held market share of over 28.9% in 2022.

- Asia Pacific region has captured 25.3% market share in 2022.

A battery management system is an electronic system that proficiently monitors and controls the overall operation of a rechargeable battery like lithium-ion and further ensures the optimum use of energy stored in a battery. Any BMS is a combination of both software and hardware components. The principal tasks performed by BMS include protecting the cell from damage in case of overcharging, supervising the charging and discharging process, determining the state-of-charge and state-of-health of the battery, cell balancing, prolonging battery life and performance, and monitoring temperature and voltage. The major application areas of battery management systems are electric vehicles, telecommunications, industrial machinery, renewable energy systems, and others.

Battery Management System Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 9.24 Billion

|

|

Market Size by 2032

|

USD 52.28 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 21.23%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Battery Type, Application, Topology, Type, Components

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Robert Bosch GmbH, Panasonic corporation, Toshiba Corp., Texas Instruments incorporated, Ricardo, Edition, East Penn Manufacturing Company, Mastervolt, Lithium balance, Microchip technology Inc., AVL, Merlin Equipment

|

Battery Management System (BMS) Market Dynamics

DRIVERS: Growing demand for efficient battery monitoring in renewable energy sector

In recent years, there has been a paradigm shift from fossil fuels toward renewable energy fuels to reduce carbon emissions and save fossil fuels from extinction. The most adopted renewable forms of energy are photovoltaic and wind energy. Although these energies are abundantly available, they are not constant and continuous sources in terms of time and output. To be able to supply the load at any point in time, storage solutions have to be adopted. Battery energy storage systems are used to store electricity and overcome the imbalance between the available energy supplied by the sources and the energy required. They offer frequency and voltage control services in case of sudden fluctuations in supply. Through battery energy storage systems, grid operators can save electricity when there is a surplus of renewable energy. Electricity can be stored in batteries and can then be distributed to cities, towns, factories, and homes when there is high demand.

RESTRAINTS: Lack of regulations related to battery management systems

The BMS has various applications, including automotive, telecommunications, renewable energy, military, and others. The BMS configurations for these applications vary and may also include customized systems according to the customer’s preference. Additionally, the BMS is classified by different topologies used in various applications. One common standard cannot serve all applications; hence, it is necessary to develop standards for the various types of BMS, topologies, and battery types. Most of the products in the market, manufactured by various companies, vary in terms of technical specifications and functions such as measuring parameters, type of estimation, communication channels, and others. Thus, finding common ground while comparing the performance of two battery management systems is perplexing.

OPPORTUNITIES: Increasing government initiatives to develop electric vehicle infrastructure

One of the major opportunities for the battery management system market is from EV charging stations. As the adoption of electric vehicles is growing both for consumer end and public transportation, setting up many e-charging stations becomes essential. Thus, the governments are helping to incentivize the number of charging stations. For instance, according to an article published by Economic Times in February 2022, EV charging stations in India have expanded by 2.5 times in megacities and are developing their charging infrastructure rapidly. Furthermore, in February 2022, the US Department of Transportation and Energy announced an allotment of USD 5 billion over 5 years to support the development of a charging station network across the country.

CHALLENGES: Fluctuations in performance due to external factors

Battery management systems are incorporated into various applications to monitor, control, and maintain the battery condition. The functions of BMS are and are not limited to determining the state of charge (SoC), state of health (SoH), the number of cycles, maintaining maximum and minimum voltage, and temperature range which require high accuracy for its effective working. The developed BMS is tested under certain conditions and environments created by the manufacturers in the development centers. After integrating the BMS with a battery-operated real-time application, there are possibilities of changed conditions, such as extreme temperatures, where the accuracy of the BMS may be affected. For instance, BMS integrated into an electric vehicle can be affected by the sudden vibration caused due to speed breakers, or the extreme temperatures caused by uncertain environments may hamper the accuracy level and performance of the BMS. Therefore, maintaining the performance level in challenging environments and under harsh external factors is a challenge for BMS systems.

Asia Pacific projected to account for the largest market share in 2022.

Asia Pacific witnesses a huge demand for battery management systems from automotive applications for electric vehicles, e-bikes, and automated guided vehicles. The energy-density lithium-ion batteries are used in these applications in which dozens of cells are stacked in a series. These cells need to be managed and controlled to avoid vehicle failure, thus making the battery management system a key element in the electric vehicle architecture. A battery management system determines the battery’s usage, state of safety, and performance. It also prolongs the battery life and extends the possible range of the vehicle.

China, being a global automotive manufacturing hub, holds immense potential for the growth of the battery management system market. The increase in the production of vehicles and batteries used in the vehicles, is driving the Chinese market. Furthermore, China is also one of the world’s leading producers of electronic devices. This is expected to drive the Chinese market across multiple applications.

Some of the prominent players in the Battery Management System Market include:

- Robert Bosch GmbH

- Panasonic corporation

- Toshiba Corp.

- Texas Instruments incorporated

- Ricardo

- Edition

- East Penn Manufacturing Company

- Mastervolt

- Lithium balance.

- Microchip technology Inc.

- AVL

- Merlin Equipment

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Battery Management System market.

By Battery Type

- Lead acid battery

- Lithium ion battery

- Nickel battery

- Flow battery

- Others

By Application

- Automotives

- Consumer electronics

- Energy storage

- Telecom

- healthcare

- Renewable

- Military and defense

By Topology

- Modular

- Distributed

- Centralized

By Type

- Motive Battery

- Stationary Battery

By Components

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)